Work From Home Office Deduction . Calculate your allowable expenses using a flat rate based on the hours you work from home each month. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. Tot up all your expenses for the year, from april 6 to april 5. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. how do i work out my home office tax deduction using actual costs? at a glance.

from www.infographicportal.com

Tot up all your expenses for the year, from april 6 to april 5. how do i work out my home office tax deduction using actual costs? at a glance. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and.

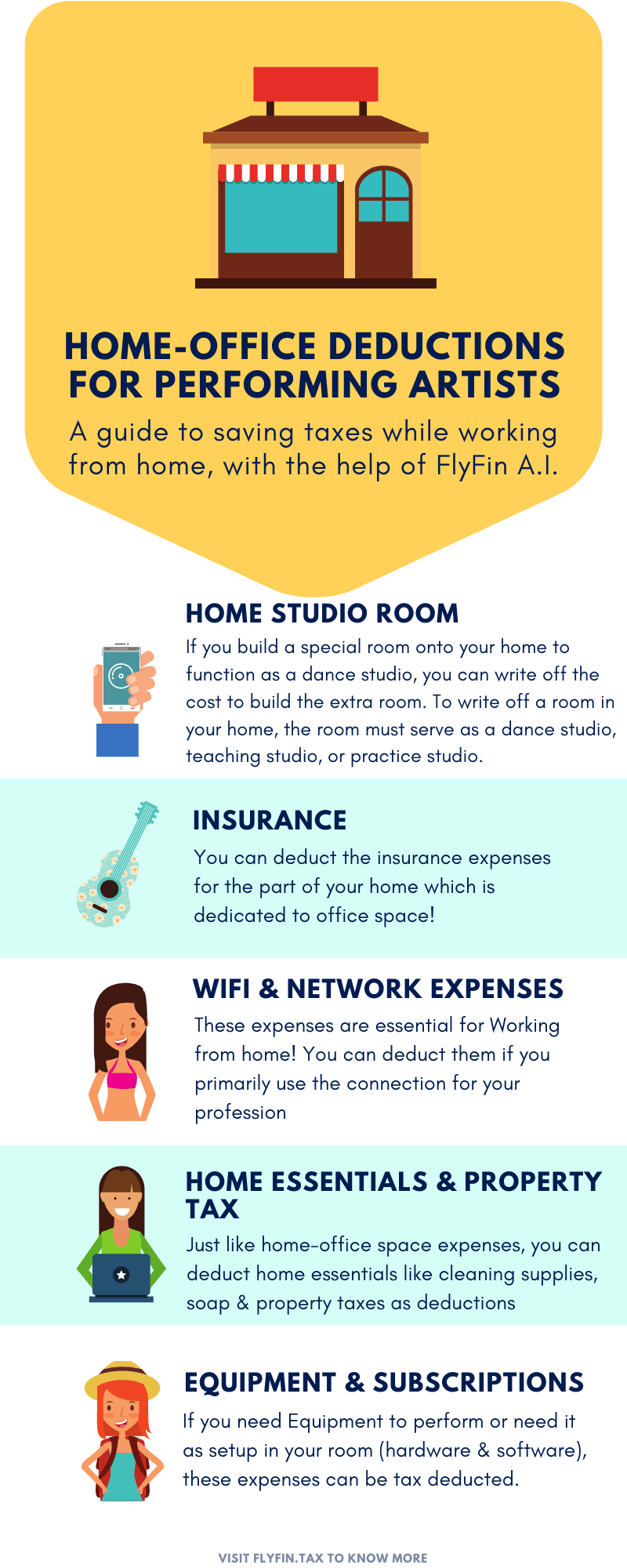

Home Office Deductions for Performing Artists Infographic Portal

Work From Home Office Deduction how do i work out my home office tax deduction using actual costs? Calculate your allowable expenses using a flat rate based on the hours you work from home each month. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. Tot up all your expenses for the year, from april 6 to april 5. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. how do i work out my home office tax deduction using actual costs? at a glance.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Work From Home Office Deduction how do i work out my home office tax deduction using actual costs? As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. when working from home, you can claim tax relief for business. Work From Home Office Deduction.

From blog.amzaccountingsolutions.com

Ultimate Guide to Home Office Deductions for Tax Savings Work From Home Office Deduction Calculate your allowable expenses using a flat rate based on the hours you work from home each month. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. how do i work out my home office tax deduction using actual costs? when working from home, you can claim tax relief for business. Work From Home Office Deduction.

From www.ramseysolutions.com

Working From Home? Home Office Tax Deduction Ramsey Work From Home Office Deduction when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. at a glance. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. how do i work out my home office tax deduction using. Work From Home Office Deduction.

From thomasdaniels800gossip.blogspot.com

Thomas Daniels Gossip Home Office Deduction 2022 Cra Work From Home Office Deduction As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. how do i work out my home office tax deduction using actual costs? at a glance. when working from home, you can claim. Work From Home Office Deduction.

From www.taxsavingspodcast.com

How Does the Home Office Deduction Work? Work From Home Office Deduction how do i work out my home office tax deduction using actual costs? Calculate your allowable expenses using a flat rate based on the hours you work from home each month. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. As an. Work From Home Office Deduction.

From www.bloomwealth.com.au

ATO Work From Home Deductions What You Need To Know Work From Home Office Deduction when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. at a glance. Tot up all your expenses for the year, from april 6 to april 5. how do i work out my home office tax deduction using actual costs? As an. Work From Home Office Deduction.

From cpennies.com

HomeOffice Deduction — Show Me the Proof! Counting Pennies LLC Work From Home Office Deduction Tot up all your expenses for the year, from april 6 to april 5. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. at a glance. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and.. Work From Home Office Deduction.

From mycfoaccountant.com

Home Office Deduction What to Know — Levesque & Associates Work From Home Office Deduction As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. how do i work out my home office tax deduction using actual costs? Calculate your allowable expenses using a flat rate based on the hours you work from home each month. when working from home, you can claim tax relief for business. Work From Home Office Deduction.

From cjdfintech.com

Maximize Your Savings Unraveling the Benefits of the Home Office Tax Work From Home Office Deduction Tot up all your expenses for the year, from april 6 to april 5. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. Calculate your allowable expenses. Work From Home Office Deduction.

From www.etsy.com

CPA Prepared Home Office Deduction Worksheet Etsy Work From Home Office Deduction Tot up all your expenses for the year, from april 6 to april 5. at a glance. how do i work out my home office tax deduction using actual costs? As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. Calculate your allowable expenses using a flat rate based on the hours. Work From Home Office Deduction.

From epicofficefurniture.com.au

5 Home Office Deductions You Should Know About Epic Office Furniture Work From Home Office Deduction As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. at a glance. Tot up all your expenses for the year, from april 6 to april 5. when working from home, you can claim. Work From Home Office Deduction.

From www.iota-finance.com

Saving on taxes using the home office deduction Work From Home Office Deduction Tot up all your expenses for the year, from april 6 to april 5. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. how do i work out my home office tax deduction using actual costs? at a glance. As an. Work From Home Office Deduction.

From www.kitces.com

Home Office Deduction Rules When Working From Home Work From Home Office Deduction how do i work out my home office tax deduction using actual costs? at a glance. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. Tot up all your expenses for the year, from april 6 to april 5. As an. Work From Home Office Deduction.

From fergusontimar.com

The Pros and Cons of the Home Office Deduction Finance Tips Work From Home Office Deduction Calculate your allowable expenses using a flat rate based on the hours you work from home each month. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’.. Work From Home Office Deduction.

From www.pinterest.com

Everything you need to know about claiming the Home Office Deduction Work From Home Office Deduction how do i work out my home office tax deduction using actual costs? at a glance. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and.. Work From Home Office Deduction.

From www.pinterest.com

Work from home? Choose from two methods of home office deduction Work From Home Office Deduction when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. Tot up all your expenses for the year, from april 6 to april 5. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. As an. Work From Home Office Deduction.

From www.infographicportal.com

Home Office Deductions for Performing Artists Infographic Portal Work From Home Office Deduction Calculate your allowable expenses using a flat rate based on the hours you work from home each month. how do i work out my home office tax deduction using actual costs? when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. at. Work From Home Office Deduction.

From welshtax.com.au

Changes to working from home deductions Welsh Tax Work From Home Office Deduction Tot up all your expenses for the year, from april 6 to april 5. when working from home, you can claim tax relief for business expenses as long as they’re ‘wholly and exclusively for the purpose of the business’. how do i work out my home office tax deduction using actual costs? Calculate your allowable expenses using a. Work From Home Office Deduction.